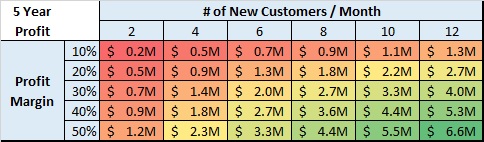

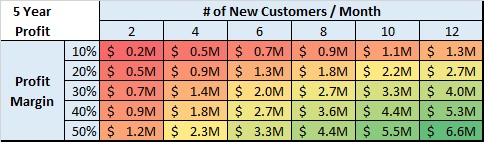

At Finance Pals we specialize in creating detailed forecasts based on key drivers such as number of new customers and revenue / costs per new customer or profit margin.

Here are our 5 steps for how to create a financial forecast.

- Get your actual expenses and revenue updated. You can do this in excel or using accounting software. You will want to check all credit cards and bank statements to make sure you capture everything

- Group the expenses and revenue into categories. Think about how you think of your businesses core operations and group those revenue and expenses together. Then start about by grouping the other expenses into another category that you can eventually separate out into 1 time or ongoing costs for marketing, travel, setup or other.

- Forecast how you think the revenue and expenses will continue for the next few months. Think about big expenses you might have coming up for taxes, marketing event, or about any seasonal impacts to your business

- Compare your Actual expenses and revenue against your forecast. This is where you will start to understand your business better and you will be able to make more accurate forecasts for the future. Once you understand your business you will be able to make strategic decisions about when to invest more money in the business and when to save cash for upcoming expenses.

- Analyze your business and look for growth and savings opportunities. Did your customers all pay on time? Did you get more new customers this month than last month? Ask yourself and your customers some why questions to really understand what is driving your business.